3.2.3 Connection

Demand Analysis

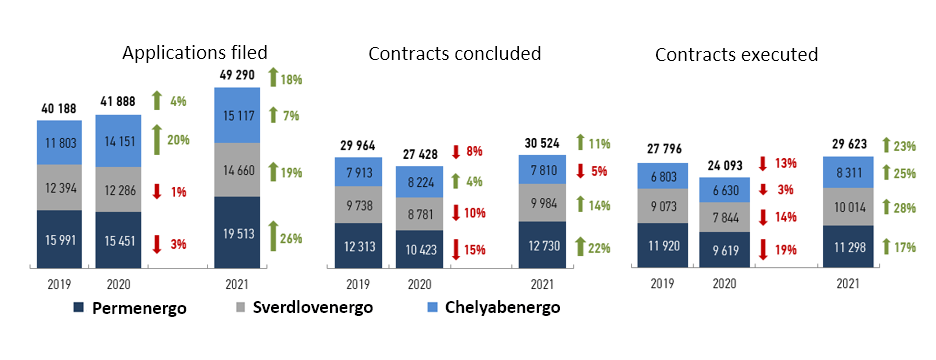

The demand for connection to the networks in 2021 increased in comparison to 2020. The total number of applications for connection, filed with the Company, grew by 18% and totaled 49,290, the growth driven by enhanced accessibility of connection due to the transition to online channels, improved purchasing power as a result of subsidized real property loans and information on possible cancellation of privilleged technological connection. The share of electronic applications filed with the use of personal account in 2021 totaled 99%. In 2021, the Company concluded 30,524 contracts (+11%YoYyear on year) and executed 29,623 contracts (+23%YoYyear on year). Capacity demand in concluded and executed contracts also increased by 1% and 18%, respectively.

Demand for connection (pcs)*

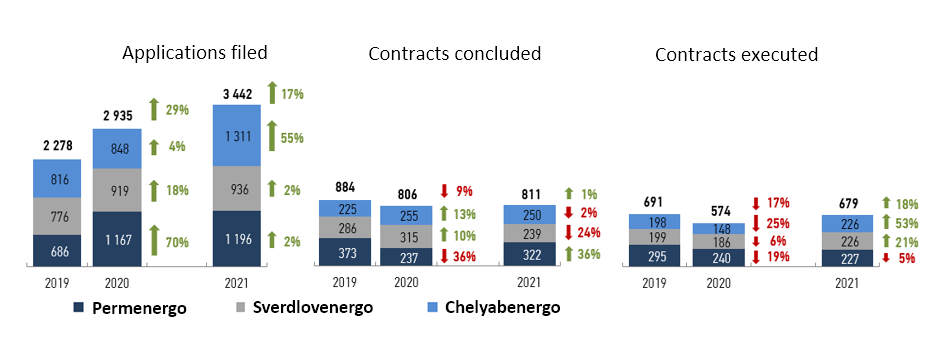

Demand for connection (MWmegawatt)*

| Metrics | MU | Period | |||

| 2019 | 2020 | 2021 | 2021/2020, % | ||

| Applications filed | pcs | 40,188 | 41,888 | 42,290 | 18% |

| Applications filed | kW | 2,277,856 | 2,935,258 | 3,442,436 | 17% |

| Contracts concluded | pcs | 29,964 | 27,428 | 30,524 | 11% |

| Contracts concluded | kW | 883,642 | 806,473 | 811,009 | 1% |

| Contracts executed | pcs | 27,796 | 24,093 | 29,623 | 23% |

| Contracts executed | kW | 691,116 | 573,941 | 678,611 | 18% |

| Active contracts | pcs | 18,874 | 19,609 | 18,725 | -5% |

| Active contracts | kW | 1,766,100 | 1,796,348 | 1,684,551 | -6% |

| Executed contracts by categories of applicants: | |||||

| 0-15 kW inclusive | pcs | 25,639 | 22,130 | 27,448 | 24% |

| 15-150 kW inclusive | pcs | 1,799 | 1,619 | 1,860 | 15% |

| 150-670 kW | pcs | 257 | 264 | 237 | -10% |

| 670+ kW | pcs | 99 | 77 | 75 | -3% |

| Generation | pcs | 2 | 3 | 3 | 0% |

| 0-15 kW inclusive | kW | 302,011 | 265,821 | 342,978 | 29% |

| 15-150 kW inclusive | kW | 107,561 | 103,301 | 129,633 | 25% |

| 150-670 kW | kW | 74,227 | 71,405 | 70,566 | -1% |

| 670+ kW | kW | 193,918 | 117,409 | 122,528 | 4% |

| Generation | kW | 13,400 | 16,005 | 12,906 | -19% |

| Revenues from connection by categories of applicants: | |||||

| 0-15 kW inclusive | RUBruble million | 39 | 42 | 64 | 54% |

| 15-150 kW inclusive | RUBruble million | 72 | 46 | 74 | 61% |

| 150-670 kW | RUBruble million | 276 | 348 | 325 | -7% |

| 670+ kW | RUBruble million | 390 | 165 | 288 | 74% |

| Generation | RUBruble million | 0 | 119 | 0 | -100% |

| Executed contracts by industries: | |||||

| Individuals | pcs | 23,300 | 19,973 | 25,085 | 26% |

| Agriculture, forestry, fishery | pcs | 195 | 175 | 152 | -13% |

| Manufacturing industry | pcs | 145 | 129 | 122 | -5% |

| Production and distribution of electricity, gas and water | pcs | 195 | 166 | 156 | -6% |

| Real estate development | pcs | 514 | 545 | 583 | 7% |

| Trade industry | pcs | 400 | 295 | 291 | -1% |

| Transportation and telecommunications | pcs | 622 | 658 | 801 | 22% |

| Public health, education, social services | pcs | 189 | 175 | 124 | -29% |

| Other | pcs | 2,236 | 1,977 | 2,309 | 17% |

| Individuals | kW | 286,475 | 250,237 | 323,086 | 29% |

| Agriculture, forestry, fishery | kW | 17,675 | 21,621 | 13,036 | -40% |

| Manufacturing industry | kW | 88,036 | 27,658 | 31,192 | 13% |

| Production and distribution of electricity, gas and water | kW | 82,310 | 46,578 | 63,474 | 36% |

| Real estate development | kW | 38,861 | 40,718 | 43,002 | 6% |

| Trade industry | kW | 17,638 | 21,836 | 14,815 | -32% |

| Transportation and telecommunications | kW | 5,045 | 5,862 | 7,549 | 29% |

| Public health, education, social services | kW | 9,443 | 11,483 | 7,005 | -39% |

| Other | kW | 145,634 | 147,948 | 175,453 | 19% |

| Metrics | MU | Period | |||

| 2019 | 2020 | 2021 | 2021/2020, % | ||

| Applications filed | pcs | 40,188 | 41,888 | 42,290 | 18% |

| Applications filed | kW | 2,277,856 | 2,935,258 | 3,442,436 | 17% |

| Contracts concluded | pcs | 29,964 | 27,428 | 30,524 | 11% |

| Contracts concluded | kW | 883,642 | 806,473 | 811,009 | 1% |

| Contracts executed | pcs | 27,796 | 24,093 | 29,623 | 23% |

| Contracts executed | kW | 691,116 | 573,941 | 678,611 | 18% |

| Active contracts | pcs | 18,874 | 19,609 | 18,725 | -5% |

| Active contracts | kW | 1,766,100 | 1,796,348 | 1,684,551 | -6% |

| Executed contracts by categories of applicants: | |||||

| 0-15 kW inclusive | pcs | 25,639 | 22,130 | 27,448 | 24% |

| 15-150 kW inclusive | pcs | 1,799 | 1,619 | 1,860 | 15% |

| 150-670 kW | pcs | 257 | 264 | 237 | -10% |

| 670+ kW | pcs | 99 | 77 | 75 | -3% |

| Generation | pcs | 2 | 3 | 3 | 0% |

| 0-15 kW inclusive | kW | 302,011 | 265,821 | 342,978 | 29% |

| 15-150 kW inclusive | kW | 107,561 | 103,301 | 129,633 | 25% |

| 150-670 kW | kW | 74,227 | 71,405 | 70,566 | -1% |

| 670+ kW | kW | 193,918 | 117,409 | 122,528 | 4% |

| Generation | kW | 13,400 | 16,005 | 12,906 | -19% |

| Revenues from connection by categories of applicants: | |||||

| 0-15 kW inclusive | RUBruble million | 39 | 42 | 64 | 54% |

| 15-150 kW inclusive | RUBruble million | 72 | 46 | 74 | 61% |

| 150-670 kW | RUBruble million | 276 | 348 | 325 | -7% |

| 670+ kW | RUBruble million | 390 | 165 | 288 | 74% |

| Generation | RUBruble million | 0 | 119 | 0 | -100% |

| Executed contracts by industries: | |||||

| Individuals | pcs | 23,300 | 19,973 | 25,085 | 26% |

| Agriculture, forestry, fishery | pcs | 195 | 175 | 152 | -13% |

| Manufacturing industry | pcs | 145 | 129 | 122 | -5% |

| Production and distribution of electricity, gas and water | pcs | 195 | 166 | 156 | -6% |

| Real estate development | pcs | 514 | 545 | 583 | 7% |

| Trade industry | pcs | 400 | 295 | 291 | -1% |

| Transportation and telecommunications | pcs | 622 | 658 | 801 | 22% |

| Public health, education, social services | pcs | 189 | 175 | 124 | -29% |

| Other | pcs | 2,236 | 1,977 | 2,309 | 17% |

| Individuals | kW | 286,475 | 250,237 | 323,086 | 29% |

| Agriculture, forestry, fishery | kW | 17,675 | 21,621 | 13,036 | -40% |

| Manufacturing industry | kW | 88,036 | 27,658 | 31,192 | 13% |

| Production and distribution of electricity, gas and water | kW | 82,310 | 46,578 | 63,474 | 36% |

| Real estate development | kW | 38,861 | 40,718 | 43,002 | 6% |

| Trade industry | kW | 17,638 | 21,836 | 14,815 | -32% |

| Transportation and telecommunications | kW | 5,045 | 5,862 | 7,549 | 29% |

| Public health, education, social services | kW | 9,443 | 11,483 | 7,005 | -39% |

| Other | kW | 145,634 | 147,948 | 175,453 | 19% |

|

|

Connection contracts cancelled during the reported period* | ||

| Contracts | MWmegawatt | Contract value, RUBruble million, net of VATvalue-added tax | |

| Permenergo | 1,268 (-34% on 2018) | 57 (-39%) | 189 (-19%) |

| Sverdlovenergo | 947 (-12%) | 36 (+20%) | 90 (+127%) |

| Chelyabenergo | 1,173 (+26%) | 57 (+2%) | 91 (-78%) |

| 2019 TOTAL | 3,388 (-14%) | 150 (-17%) | 370 (-46%) |

| Permenergo | 824 (-35% on 2019) | 95 (+67%) | 123 (-35%) |

| Sverdlovenergo | 715 (-24%) | 21 (-42%) | 26 (-71%) |

| Chelyabenergo | 1,056 (-10%) | 76 (+33%) | 125 (+37%) |

| 2020 TOTAL | 2,595 (-23%) | 192 (+28%) | 274 (-26%) |

| Permenergo | 679 (-18% on 2020) | 33 (-65%) | 83 (-33%) |

| Sverdlovenergo | 356 (-50%) | 63 (+200%) | 59 (+127%) |

| Chelyabenergo | 768 (-27%) | 105 (+38%) | 99 (-21%) |

| 2021 TOTAL |

|

201 (+5%) | 241 (-12%) |

|

|

Connection contracts cancelled during the reported period* | ||

| Contracts | MWmegawatt | Contract value, RUBruble million, net of VATvalue-added tax | |

| Permenergo | 1,268 (-34% on 2018) | 57 (-39%) | 189 (-19%) |

| Sverdlovenergo | 947 (-12%) | 36 (+20%) | 90 (+127%) |

| Chelyabenergo | 1,173 (+26%) | 57 (+2%) | 91 (-78%) |

| 2019 TOTAL | 3,388 (-14%) | 150 (-17%) | 370 (-46%) |

| Permenergo | 824 (-35% on 2019) | 95 (+67%) | 123 (-35%) |

| Sverdlovenergo | 715 (-24%) | 21 (-42%) | 26 (-71%) |

| Chelyabenergo | 1,056 (-10%) | 76 (+33%) | 125 (+37%) |

| 2020 TOTAL | 2,595 (-23%) | 192 (+28%) | 274 (-26%) |

| Permenergo | 679 (-18% on 2020) | 33 (-65%) | 83 (-33%) |

| Sverdlovenergo | 356 (-50%) | 63 (+200%) | 59 (+127%) |

| Chelyabenergo | 768 (-27%) | 105 (+38%) | 99 (-21%) |

| 2021 TOTAL |

|

201 (+5%) | 241 (-12%) |

Connection requests are waived due to changes in terms for construction of filer’s facility, lack of intentions to construct any facilities, lack of funds or expiration of specifications.

During 2021, Permenergo cancelled 679 contracts (-18%YoYyear on year) with the total capacity of 33 MWmegawatt and worth RUBruble 83 million (net of VATvalue-added tax). Most of the contracts (83%) were cancelled by 0-15 kW applicants, 68% of cancellations done by individuals.

During 2021, Sverdlovenergo cancelled 356 contracts (-50% YoYyear on year) with the total capacity of 63 MWmegawatt and worth RUBruble 59 million. Most of the contracts (83%) were cancelled by 0-15 kW applicants, 75% of cancellations done by individuals.

During 2021, Chelyabenergo cancelled 768 contracts (-27% YoYyear on year) with the total capacity of 105 MWmegawatt and worth RUBruble 99 million. Most of the contracts (78%) were cancelled by 0-15 kW applicants, 70% of cancellations done by individuals.

The most important connections in 2021 are:

- Administration of Baikalovo Municipal District (RUBruble 11 million, 0.42 MWmegawatt): connection of a 550-seat secondary school (advancement of education in the Sverdlovsk region).

- ОООLimited Liability Company Krasnoturinsk — Polymetall (RUBruble 235 million, 7 MWmegawatt): power supply of zinc and copper-zinc ore processing plant (development of metallurgic industry in the Sverdlovsk region).

- ОАОOpen Joint-Stock Company Serov Ferro-Alloy Plant (RUBruble 1.5 million, 7.6 MWmegawatt): power supply of dust-collecting unit for furnaces and melt mixing units (development of metallurgic industry in the Sverdlovsk region).

- ОООLimited Liability Company Splav-1 (RUBruble 1.2 million, 0.73 MWmegawatt): power supply of dust-collecting unit for furnaces and melt mixing units (development of metallurgic industry in the Sverdlovsk region)

- MKUmunicipal public institution Capital Construction Directorate of Perm (RUBruble 19 million, 0.44 MWmegawatt): connection of a 1200-seat secondary school (advancement of education in the Perm region).

- MAUmunicipal autonomous educational institution Youth Hall of Perm (RUBruble 18 million, 0.59 MWmegawatt): reconstruction of a Youth Hall building (advancement of education in the Perm region).

- ОООLimited Liability Company SZ PKI (RUBruble 15 million, 0.9 MWmegawatt): power supply of apartment building (development of house construction and improved housing affordability in Perm).

- AOJoint-Stock Company Karyer (RUBruble 0.8 million, 4 MWmegawatt): power supply of cement plant (development of construction in the Perm region).

- Ministry of Construction and Infrastructure of the Chelyabinsk region (RUBruble 35 million, 0.6 MWmegawatt): connection of a secondary school (advancement of education in the Sverdlovsk region).

- MBU Utilities, Construction and Electricity Supply Directorate of Kunashak Municipal District (RUBruble 8 million, 0.3 MWmegawatt): connection of a 500-seat secondary school (advancement of education in the Chelyabinsk region).