4.13 Stockholder Equity and Securities

As of 31.12.2021, the charter capital of the Company totaled RUBruble 8,743,048,571.1 (or 87,430,485,711 common shares with par value of RUBruble 0.1 each). OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals has not placed preferred shares.

| Stocks | Quantity | Face value |

| Outstanding common shares | 87,430,485,711 | RUBruble 0.1 |

| Authorized common shares | 2,475,713,367 | RUBruble 0.1 |

There were no changes of the Company’s charter capital during 2021, no additional shares were issued or placed in 2021. As of 31.12.2021, the register comprises 16,157 registered accounts, incl. 7 nominal holders, 99 legal entities, 15,903 individuals, 147 common-property accounts and 1 undefined owner account.

| State registration number | 1-01-32501-D dated 03.05.2005 |

| ticker | MRKU |

| ISIN | RU000A0JPPT1 |

During the reported period ordinary shares of the Company were listed in Level 2 Quotation List of PAOPublic Joint-Stock Company Moscow Exchange, they were also included into the MOEXEUMoscow Exchange Energy & Utilities index (until 18.06.2021).

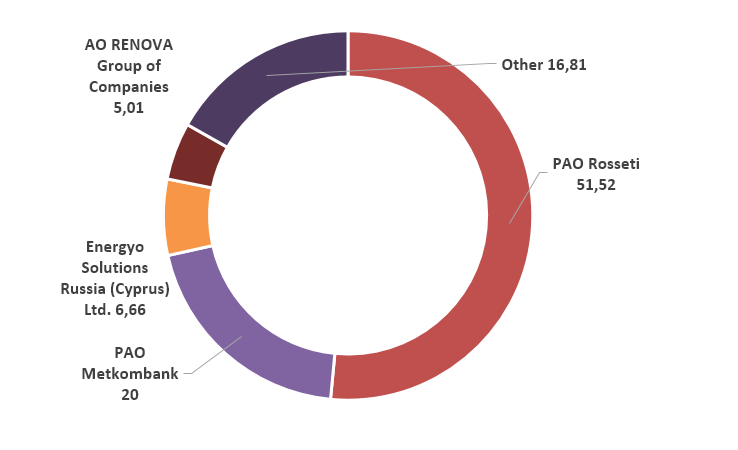

Company’s shareholder structure:

In September 2021, the share in the Company’s charter capital, owned by Federal Property Fund (3.71%), was transferred as a payment for the additional share issue of AOJoint-Stock Company DVEUK – ENES. There were no other changes among entities with direct or indirect control of 5%+ of votes attributed to voting shares in 2021. OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals has no information on other blocks of stock over 5% except for these already disclosed above. Shares owned by the Company and its controlled entities: none. Information on certain stockholders’ potential or actual control, stretching out beyond their stakes in the charter capital (incl. shareholder agreements): none. Ordinary and preferred shares of unequal par value: none.

SHAREHOLDER RIGHTS

The Russian legislation guarantees that any common share gives equal rights to any shareholder. Therefore, our shareholders are entitled to:

- Participate in a General Meeting of Stockholders (in person or by proxy) with voting power on all respective matters.

- Introduce own proposals to the agenda of a General Meeting of Stockholders in a manner set forth by the Russian legislation and Company’s Charter.

- Obtain information on the Company and get familiarized with Company’s documents in line with Article 91 of the Federal Joint-Stock Companies’ Law, other regulatory enactments and Charter.

- Collect dividends announced by the Company.

- Preemptive acquisition of additional shares and convertible securities, placed by subscription, pro rata to the ownership in cases stipulated by the Russian legislation.

- Obtain parts of the Company’s property in case of its liquidation.

- Enjoy other rights guaranteed by the Russian legislation and Charter.

A stockholder or a group of stockholders with at least 2% of the voting stock are entitled to introduce issues to the agenda of a General Meeting of Stockholders and promote nominees for election to the Board of Directors and Board of Internal Auditors of the Company. A stockholder or a group of stockholders with at least 10% of the voting stock are entitled to initiate an extraordinary General Meeting of Stockholders of the Company.

The rights of IDGCInterregional Distribution Grid Company of Urals’ stockholders are guaranteed by the following:

- The Company publicly discloses:

- the General Meeting of Stockholders notice and materials on agenda items within 30 days prior to the General Meeting;

- recommendations provided by the Board of Directors regarding items of the General Meeting agenda through press releases, corporate actions/events and minutes of the Board of Directors’ meetings;

- date when entities, entitled to participate in the General Meeting of Stockholders, are defined within 7 days prior to the record date;

- minutes of the meetings of stockholders on the corporate web-site.

- The Company’s stockholders may submit proposals to be included into the agenda of the annual general meeting of stockholders within 60 days after the end of the calendar year.

- Registration of entities, entitled to participate in the general meeting of stockholders, is stipulated in details by the Regulations on the General Meeting of Stockholders.

- The Company’s registrar performs the functions of the Counting Commission during the general meeting of stockholders. Since December 2010 the Company’s registrar is AOJoint-Stock Company STATUS (official web-site: www.rostatus.ru).

- Voting results at the general meeting of stockholders are announced prior to the conclusion of the meeting and disclosed in a statutory manner.

- The Company has the Dividend Policy stipulating primary principles of dividend payments, mechanics of dividend decision-taking, procedure, deadlines and form of dividend payments. The relevant Policy is disclosed on the official web-site of the Company[1].

The decision to pay dividend allows stockholders to receive full details regarding dividend amount, payment procedure and deadlines.

THE COMPANY AND STOCK MARKET

| 2019 | 2020 | 2021 | 2021/2021, % | |

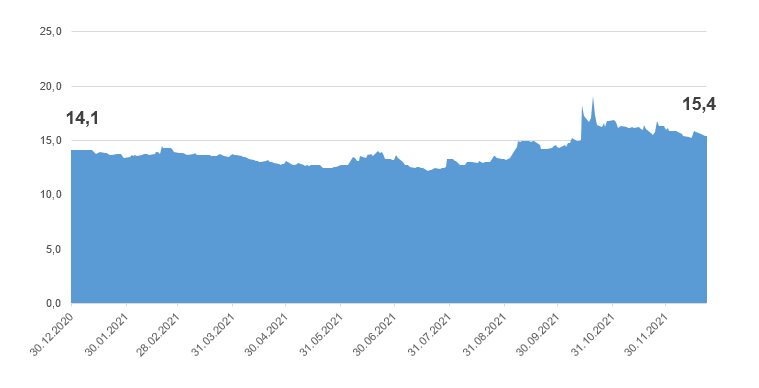

| Market capitalization as of the last trading day, RUBruble billion | 14.4 | 14.1 | 15.4 | +9.2 |

| Trading volume, RUBruble million | 347.1 | 450.2 | 622.3 | +38.2 |

| Trading volume, billion shares | 1.9 | 3.1 | 3.4 | +9.7 |

| Transactions, thousand | 23.5 | 40.9 | 55.6 | +35.9 |

The Company’s market value as of the last trading day (30.12.2021) totaled RUBruble 15.4 billion.

Fluctuations of the OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals market capitalization in 2021 (RUBruble billion)

Source: Moscow Stock Exchange (www.moex.com).

The price for the Company’s common shares gained 9.2% during 2021, starting from RUBruble 0.1618 (average weighted price of the last trading day of 2020) and ending RUBruble 0.1766 (average weighted price of the last trading day of 2021).

During 2021, world stock markets, particularly, Russian stock market, were impacted by multiple adverse events and shocks: Fx and oil price fluctuations, deceleration of global economic growth, pressure on emerging markets and trade clashes, introduction of several sanctions packages against Russia.

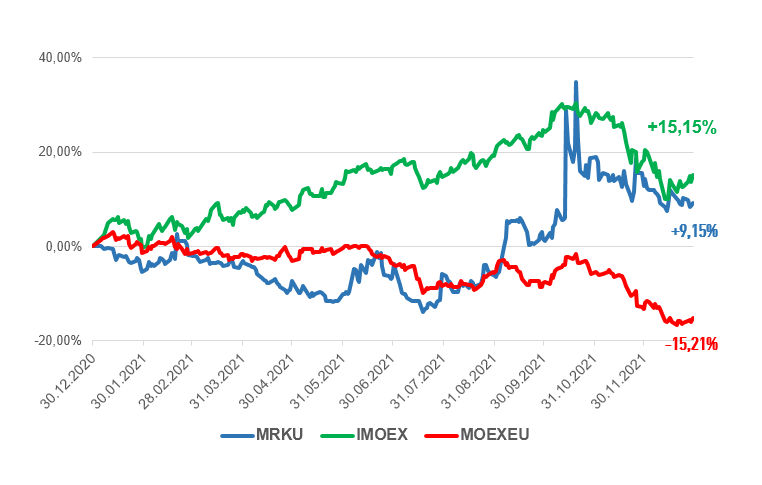

Fluctuations of OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals stock quotes, indices of the Moscow Stock Exchange (IMOEXMoscow Exchange index and MOEXEUMoscow Exchange Energy & Utilities index) in 2021 (in %)

Source: Moscow Stock Exchange (www.moex.com).

During 1H 2021 the fluctuations of the Company’s stock quotes mainly copycatted the MOEXEUMoscow Exchange Energy & Utilities index movements. Only in April and May the quotes plunged lower than MOEXEUMoscow Exchange Energy & Utilities index, driven by external and internal factors (nosedive of the Russian stock market due restrictions regarding RUBruble-nominated sovereign debt, recommendations of the Board of Directors to abstain from FY2020financial year 2020 dividend paout, etc.). In October 2021, positive trends of the Russian stock market, reaching historic peaks on the back of skyrocketed oil prices, had an impact on the Company’s share prices. Thus, in mid-October the average price totaled RUBruble 0.2 (+28.8% YTD). However, in 4Q 2021 the spread of a new COVIDcoronavirus disease-19 variant, tightening of the Bank of Russia’s monetary policy and enduring geopolitical pressure had an adverse influence on the Russian stock market sending it into a large-scale correction. MOEX grew 15.2% during 2021. MOEXEUMoscow Exchange Energy & Utilities index showed worse performance, losing 15.2% by the year-end.

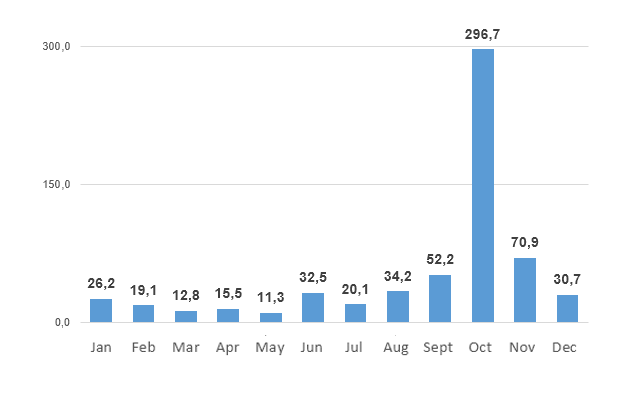

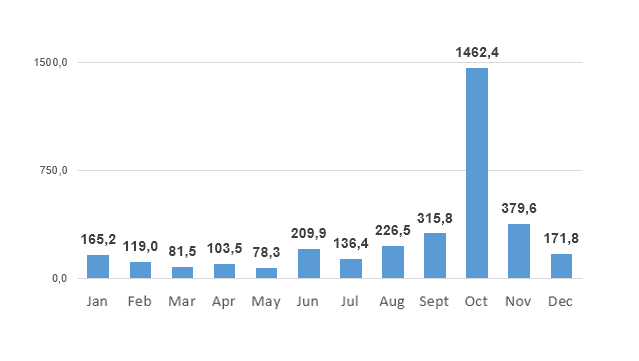

IDGCInterregional Distribution Grid Company of Urals’ trading volume in RUBruble million in 2021 (main market)

Source: Moscow Stock Exchange (www.moex.com).

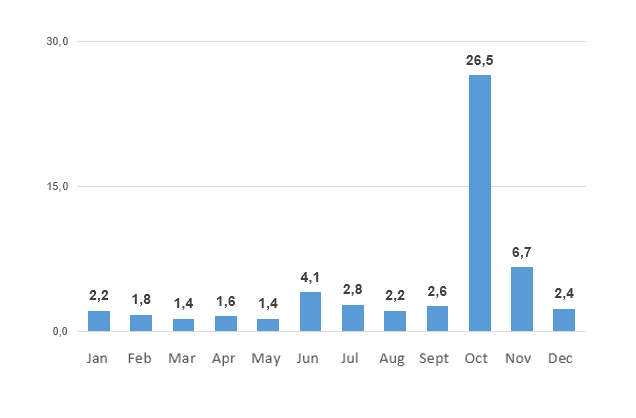

IDGCInterregional Distribution Grid Company of Urals’ trading volume in million shares in 2021 (main market)

Source: Moscow Stock Exchange (www.moex.com).

Number of transactions with OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals shares in 2021, thousand (main market)

Source: Moscow Stock Exchange (www.moex.com).

The annual trading volume in monetary terms and quantitative terms totaled RUBruble 622.3 million (+38.2% YoYyear on year) and 3.4 billion shares (+9.7% YoYyear on year), respectively. The annual number of transactions amounted to 55.6 thousand (+35.9% YoYyear on year).

Bonds

| Key parameters of securities | Series BOexchange-traded bonds-03 exchange-traded bonds | Series BOexchange-traded bonds-04 exchange-traded bonds |

| Amount | 3,000,000 | 4,000,000 |

| Face value, RUBruble | 1,000.00 | 1,000.00 |

| Volume, RUBruble | 3,000,000,000.00 | 4,000,000,000.00 |

| ID / Registration number | 4B02-03-32501-D | 4B02-04-32501-D |

| Date of ID / Registration number assignment | 31.05.2013 | 31.052013 |

| Placed on | 30.10.2019 | 30.10.2019 |

| Maturity | 10 years | 10 years |

| Offer / Redemption | 31.10.2022/17.10.2029 | 31.10.2022/17.10.2029 |

| Coupon rate, % p.a. | 7.00 | 7.00 |

| Coupon yield per bond, RUBruble | 34.90 | 34.90 |

| Exchange | PAOPublic Joint-Stock Company Moscow Exchange | PAOPublic Joint-Stock Company Moscow Exchange |

| Listing | 2 | 2 |

| Key parameters of securities | Series BOexchange-traded bonds-03 exchange-traded bonds | Series BOexchange-traded bonds-04 exchange-traded bonds |

| Amount | 3,000,000 | 4,000,000 |

| Face value, RUBruble | 1,000.00 | 1,000.00 |

| Volume, RUBruble | 3,000,000,000.00 | 4,000,000,000.00 |

| ID / Registration number | 4B02-03-32501-D | 4B02-04-32501-D |

| Date of ID / Registration number assignment | 31.05.2013 | 31.052013 |

| Placed on | 30.10.2019 | 30.10.2019 |

| Maturity | 10 years | 10 years |

| Offer / Redemption | 31.10.2022/17.10.2029 | 31.10.2022/17.10.2029 |

| Coupon rate, % p.a. | 7.00 | 7.00 |

| Coupon yield per bond, RUBruble | 34.90 | 34.90 |

| Exchange | PAOPublic Joint-Stock Company Moscow Exchange | PAOPublic Joint-Stock Company Moscow Exchange |

| Listing | 2 | 2 |

During the circulation period, in particular, in 2021, the Company complied with its obligations to pay out coupons in due terms and in full. No exchange-traded bonds were placed in 2021.

As of 31.12.2021 the list of securities admitted for trading at PAOPublic Joint-Stock Company Moscow Exchange contains the following bonds:

- Series BOexchange-traded bonds-02 exchange-traded bonds with par value of RUBruble 3 billion, 10-year maturity (ID No. 4B02-02-32501-D dated 31.05.2013). Under the offer, the Company has redeemed the bonds on 19.11.2019 in full previously placed amount of RUBruble 1.6 billion;

- Series BOexchange-traded bonds-05 exchange-traded bonds with par value of RUBruble 5 billion, 10-year maturity (ID No. 4B02-05-32501-D dated 31.05.2013). Under the offer, the Company has redeemed the bonds on 23.08.2019 in full.

The Company has also registered Series 001R Exchange-Traded Bond Program (ID No. 4-32501-D-001P-02E dated 08.02.2017). Total ceiling par value of exchange-traded bonds to be placed under the program is RUBruble 25.0 billion. Maximum maturity of exchange-traded bonds to be placed under the program is 30 years since the effective date. The maturity of the ETB program is 50 years since the date of the ID assignment to the Program.

ALLOCATION OF PROFIT AND DIVIDEND POLICY

The Company’s dividend policy focuses on the enhancement of the Company’s investment prospects and market value, balancing between interests of the Company and its stockholders. The Company’s dividend policy is stipulated by the Regulations on the Dividend Policy[96].

Fundamentals of the Company’s Dividend Policy

- Compliance of the Company’s dividend accrual and payout practices with laws of Russia and corporate governance standards[97];

- Optimum compromise between the interests of the Company and its stockholders;

- Specification of a dividend size at a minimum of 50% of net income, presented in the financial statements (incl. consolidated statements, prepared under IFRSInternational Financial Reporting Standards), calculated in a manner stated by the Regulations;

- Provision of possibility to pay quarterly dividends, provided that corresponding criteria are complied with;

- Enforcement of utmost transparency (comprehensibility) of a tool for dividend size calculation and payout;

- Enforcement of dividend upward trend, provided that Company’s net income keeps growing;

- Availability of information on the Company’s dividend policy for stockholders and stakeholders;

- Maintenance of required financial and technical condition of the Company (execution of investment program), enforcement of the Company’s development.

| RUBruble thousand | FY2018financial year 2018 | FY2019financial year 2019 | FY2020financial year 2020 |

| (AGM held in 2019) | (AGM held in 2020) | (AGM held in 2021) | |

| Unallocated profit (loss) of the reported period, incl: | 797,526 | 2,155,068 | 19,328 |

| Reserve fund | 0 | 0 | 0 |

| Enterprise development | 535,235 | 1,237,048 | 19,328 |

| Dividends | 262,291 | 918,02 | 0 |

| Recovery of losses of previous periods | 0 | 0 | 0 |

| RUBruble thousand | FY2018financial year 2018 | FY2019financial year 2019 | FY2020financial year 2020 |

| (AGM held in 2019) | (AGM held in 2020) | (AGM held in 2021) | |

| Unallocated profit (loss) of the reported period, incl: | 797,526 | 2,155,068 | 19,328 |

| Reserve fund | 0 | 0 | 0 |

| Enterprise development | 535,235 | 1,237,048 | 19,328 |

| Dividends | 262,291 | 918,02 | 0 |

| Recovery of losses of previous periods | 0 | 0 | 0 |

Pursuant to the Company’s charter, the Annual General Meeting of Stockholders will decide upon allocation of the FY2021financial year 2021 profit.

| Resolution date | Accrued dividends, RUBruble | Dividend per share, RUBruble | Dividends paid, RUBruble | Dividends paid, % | |

| FY2020financial year 2020 | AGM Minutes No.17 dated 03.06.2021 | 0.00 | 0.00 | 0.00 | 0.00 |

| FY2019financial year 2019 | AGM Minutes No.16 dated 29.05.2020 | 638,242,542.53 | 0.0073 | 631,121,847.55 | 98.88 |

| 9M2019 | EGM Minutes No.15 dated 31.12.2019 | 279,777,557.22 | 0.0032 | 277,237,869.91 | 99.09 |

| FY2018financial year 2018 | AGM Minutes No.13 dated 24.05.2019 | 262,291,461.68 | 0.0030 | 260,130,020.09 | 99.17 |

| Resolution date | Accrued dividends, RUBruble | Dividend per share, RUBruble | Dividends paid, RUBruble | Dividends paid, % | |

| FY2020financial year 2020 | AGM Minutes No.17 dated 03.06.2021 | 0.00 | 0.00 | 0.00 | 0.00 |

| FY2019financial year 2019 | AGM Minutes No.16 dated 29.05.2020 | 638,242,542.53 | 0.0073 | 631,121,847.55 | 98.88 |

| 9M2019 | EGM Minutes No.15 dated 31.12.2019 | 279,777,557.22 | 0.0032 | 277,237,869.91 | 99.09 |

| FY2018financial year 2018 | AGM Minutes No.13 dated 24.05.2019 | 262,291,461.68 | 0.0030 | 260,130,020.09 | 99.17 |

A number of entities, included into the list of entities entitled to collect dividends, collected no dividends, as they had not provided the registrar with relevant information on details required for dividend transfers.

COMMUNICATIONS WITH STOCKHOLDERS, INVESTORS AND OTHER STOCK MARKET PARTICIPANTS

OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals aims to promptly and regularly convey information about its operations to all those interested in receiving it to the extent necessary for them to make an informed decision about acquiring an interest in the Company or other actions that are capable of affecting the Company’s financial and business operations.

The Company maintains a special web-page (https://rosseti-ural.ru/en/ir/), with answers to frequently asked questions from stockholders and investors, a regularly updated calendar of corporate events, dividend history, key performance indicators as well as other information that investors and stockholders may find useful.

The Company also uses its official web-page at Interfax newswire system (http://www.e-disclosure.ru/portal/company.aspx?id=12105) to disclose corporate events or actions, annual and quarterly reports, accounting (financial) statements, etc.

| USEFUL LINKS | |

| FINANCIAL REPORTING | |

| under Russian Accounting Standards | http://rosseti-ural.ru/en/ir/financial-information/ras/ |

| under International Financial Reporting Standards | http://rosseti-ural.ru/en/ir/financial-information/ifrs/ |

| IR CALENDAR | http://rosseti-ural.ru/en/ir/analyst-center/ir-calendar/ |

| QUICK ANALYZER | http://rosseti-ural.ru/en/ir/analyst-center/quick-analyzer/ |

| INFORMATION DISCLOSURE | |

| Corporate actions and events | http://rosseti-ural.ru/en/disclosure/issuer/corporate-actions/ |

| Lists of affiliated entities | http://rosseti-ural.ru/en/disclosure/issuer/affiliate/ |

| Quarterly reports | http://rosseti-ural.ru/en/disclosure/issuer/quarterly-reports/ |

| Annual reports | http://rosseti-ural.ru/en/disclosure/issuer/annual-reports/ |

| GOVERNING AND CONTROL BODIES | http://rosseti-ural.ru/en/company/controls/ |

| HIGHLIGHTS | http://rosseti-ural.ru/en/company/highlights/finance/ |

| USEFUL LINKS | |

| FINANCIAL REPORTING | |

| under Russian Accounting Standards | http://rosseti-ural.ru/en/ir/financial-information/ras/ |

| under International Financial Reporting Standards | http://rosseti-ural.ru/en/ir/financial-information/ifrs/ |

| IR CALENDAR | http://rosseti-ural.ru/en/ir/analyst-center/ir-calendar/ |

| QUICK ANALYZER | http://rosseti-ural.ru/en/ir/analyst-center/quick-analyzer/ |

| INFORMATION DISCLOSURE | |

| Corporate actions and events | http://rosseti-ural.ru/en/disclosure/issuer/corporate-actions/ |

| Lists of affiliated entities | http://rosseti-ural.ru/en/disclosure/issuer/affiliate/ |

| Quarterly reports | http://rosseti-ural.ru/en/disclosure/issuer/quarterly-reports/ |

| Annual reports | http://rosseti-ural.ru/en/disclosure/issuer/annual-reports/ |

| GOVERNING AND CONTROL BODIES | http://rosseti-ural.ru/en/company/controls/ |

| HIGHLIGHTS | http://rosseti-ural.ru/en/company/highlights/finance/ |

FREQUENTLY ASKED QUESTIONS AND ANSWERS

How can I know the exact amount of the Company’s shares owned by me?

To see the exact amount of the Company’s shares owned by you, you need to contact our registrar AOJoint-Stock Company STATUS at its HQheadquarters (located at: 23/1 Ulitsa Novokhokhlovskaya, Moscow, Russia, 109052) or its regional branches (explore the official registrar’s web-site at www.rostatus.ru to find the nearest office near you). Please, be aware that you should have your ID with you to pick up the account statement containing the exact amount of the Company’s shares owned by you.

I have problems with collecting dividends through my bank account, though general meetings of stockholders regularly vote for dividend allocation. What should I do to finally collect the dividends?

The problem seemingly lies in incorrect or fragmentary data regarding your bank account or taxpayer ID number. You should contact our registrar (AOJoint-Stock Company STATUS) to clear this up.

I do not receive the voting papers from your company to be able to vote at general meetings of stockholders. What should I do to start receiving the voting papers?

The register seemingly contains incorrect address details. To alter it, you should contact any registrar’s office, nearest to you. The registrar alters the register only using relevant data of a questionnaire completed by the stockholder. This questionnaire can be downloaded from the official registrar’s web-site (www.rostatus.ru) for completion. Alteration services are to be paid for in line with the current fees disclosed by the registrar. Please, explore the official registrar’s web-site to find more details on alteration procedure.

Focus on ESG investors

To enhance confidence of investors, consumers and other stakeholders, the Company strives to disclose, to the greatest possible extent, information on sustainable development factors (ESG-factors), which are the focus of attention of socially responsible investors during their investment decision-taking.

[1] Section Incorporating Documents and Bylaws (Main/About us/ Incorporating Documents and Bylaws)